Over the last decade, dates have evolved from a traditional Middle Eastern staple into a global health food phenomenon. Once known mainly for their cultural and religious significance, today they are recognized as a natural sweetener, energy booster, and functional ingredient across the food industry. The growing global demand for dates reflects broader consumer trends: a shift toward natural, plant-based, and nutrient-rich foods.

Health-conscious consumers are seeking alternatives to refined sugar, fueling innovation in date-based products such as syrups, pastes, and snack bars. At the same time, advancements in agriculture, processing, and logistics have made dates more accessible than ever, allowing producers from the Middle East and North Africa to reach new markets in Asia, Europe, and the Americas.

This rising demand creates a window of opportunity for Latin America, a region with strong agricultural potential and growing interest in healthy foods. Understanding what drives the global date market is essential for importers, distributors, and food businesses seeking to participate in this expanding trade.

1. Global Growth: Why Dates Are in High Demand Worldwide

2. Latin America’s Opportunity: Why This Region Can Benefit

3. Import & Distribution: Key Steps for Local Businesses

4. Future Outlook: Trends That Will Shape the Market

1. Global Growth: Why Dates Are in High Demand Worldwide

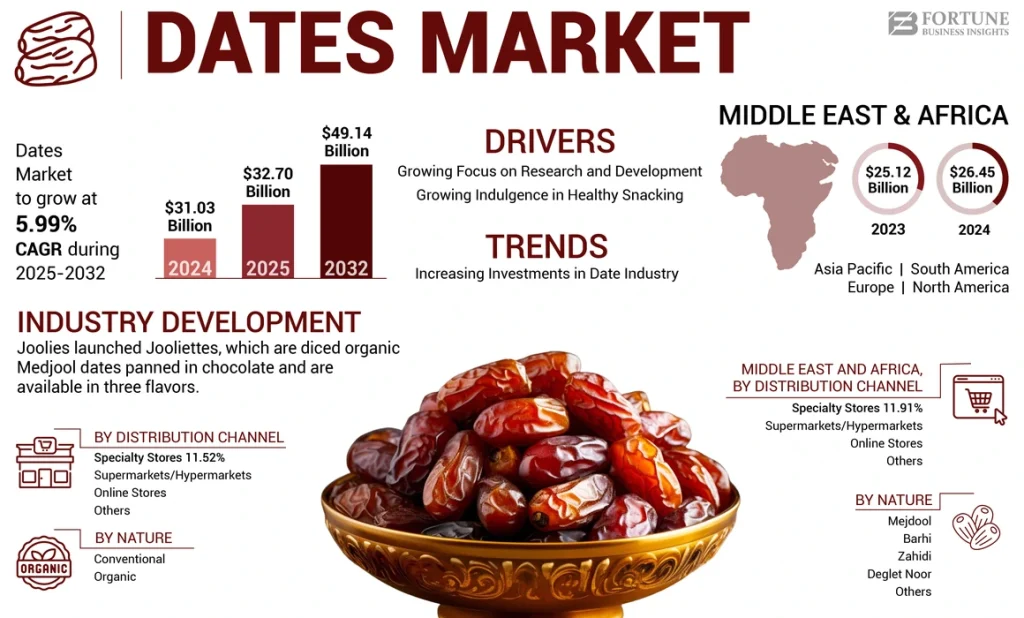

Key factors driving the global surge in date consumption and trade include a rising health-conscious consumer base, innovation in date-based food products, and the expansion of trade into new international markets. Advancements in technology and increasing government support in producing countries also play a significant role.

Consumer and health trends

- Growing demand for natural sweeteners: As consumers reduce their intake of refined sugar, the market for natural alternatives is expanding. Dates, known for their rich nutritional profile and inherent sweetness, have become a popular substitute in baking, snacks, and beverages.

- Expansion of vegan and plant-based diets: The global shift toward vegan and plant-based lifestyles has driven increased demand for dates. Dates serve as a natural, plant-based ingredient in products like energy bars, smoothies, and dairy-free desserts.

- Healthy snacking habits: The fast-paced urban lifestyle has led to a rise in demand for convenient, healthy, and nutritious snack options. Dates offer essential vitamins, minerals, and fiber, making them an ideal choice for health-conscious consumers and athletes.

- Increased health awareness: A growing body of research highlighting the health benefits of dates, such as improving heart and brain health and lowering cholesterol, has fueled consumer interest. The fruit’s low glycemic index also makes it a suitable option for those managing blood sugar.

- Preference for organic and premium dates: Consumers in markets like North America and Europe are increasingly seeking ethically sourced, pesticide-free organic dates. Premium varieties like Medjool are particularly popular due to their flavor and texture.

Product innovation and market expansion

- Diversification of date products: Manufacturers are creating innovative, value-added products to attract new consumer segments. These include date paste, date syrup, date powder, and packaged date snacks.

- New markets for date exports: The global market for dates has expanded beyond traditional consumer regions in the Middle East and North Africa. Rising incomes and health consciousness in emerging markets, such as India and China, have created major new opportunities for exporters.

- Growth in online retail: E-commerce has increased the global accessibility of dates, allowing consumers to easily purchase different varieties from around the world. This online expansion supports direct-to-consumer sales and broadens market reach.

Production and trade logistics

- Technological advancements: Improvements in farming and processing technologies are boosting the efficiency and quality of date production. Modern irrigation and processing techniques increase yields and extend the shelf life of dates, making them easier to trade over long distances.

- Expansion of cold-chain infrastructure: Improvements in cold storage and transportation infrastructure ensure that dates retain their freshness during export, helping to meet stringent food safety standards in new markets.

- Government support and investment: In major producing countries like Saudi Arabia and the United Arab Emirates, governments are investing in the date sector to boost production, improve quality, and expand export infrastructure.

- Growing demand in the food industry: The versatility of dates is driving their expanded use as a food ingredient. Food manufacturers use dates to enhance the nutritional value of snacks, energy bars, and baked goods. Source

2. Latin America’s Opportunity: Why This Region Can Benefit

Latin American countries can meet the rising demand for dates by focusing on developing local production, enhancing export infrastructure, pursuing premium varieties like Medjool, and diversifying into value-added date products. Mexico is already a major player, but the entire region can leverage its agricultural potential to capitalize on the growing global market.

Develop local production

- Invest in agriculture: With government support and appropriate policy frameworks, Latin American countries can attract the necessary investments to expand date palm cultivation.

- Improve agricultural practices: Utilizing advanced irrigation techniques, such as drip irrigation, is crucial for water efficiency in arid regions. Adopting new technologies and management practices can help sustain productivity and manage abiotic stresses like water shortages, high temperatures, and pests.

- Boost small and medium producers: Organizing smaller growers into co-ops for packing and marketing can help them overcome commercialization challenges and better access both domestic and international markets.

- Increase yields: Mexico’s date industry demonstrates that yields can be improved through better cultural practices, potentially from 7.9 tons/ha to 10 tons/ha. This success can be replicated in other suitable regions.

Enhance export capabilities

- Strengthen supply chains: Latin American countries should prioritize investments in logistics, cold-chain infrastructure, and trade policies to facilitate easier exports. These improvements help navigate complex trade regulations and ensure product quality over long distances.

- Expand market access: By diversifying export markets and reducing reliance on traditional partners, countries can create new trade opportunities. Some Latin American countries are already showing strong growth in date imports and exports, highlighting potential for broader market engagement.

Focus on premium and value-added products

- Target premium market segments: By focusing on high-quality varieties like Medjool, Latin American producers can capitalize on premium market positioning and higher prices. Mexico has already found success exporting its Medjool dates.

- Innovate with date-based products: Meeting rising demand requires expanding beyond raw dates. Developing and marketing date paste, syrup, and powder for the food industry can open new revenue streams. Focusing on ready-to-eat snacks for health-conscious consumers can also be a viable strategy.

- Diversify into niche markets: The global rise in sustainable agriculture presents an opportunity. Targeting niche markets for organic dates, for example, can attract higher price premiums and encourage the adoption of environmentally friendly practices, appealing to a growing consumer base that values sustainability.

Build regional market leadership

- Capitalize on regional demand: Latin American countries can serve their own growing market. Regions with high consumption growth rates, such as Brazil and Argentina, offer strong domestic market opportunities. Promoting the health benefits of dates within the region can help stimulate internal demand and build a solid consumer base.

- Utilize existing trade networks: Nearshoring and existing trade agreements offer a foundation for expanding date exports within the region and beyond. Leveraging these networks can help Latin American countries become more resilient in global supply chains. Source

3. Import & Distribution: Key Steps for Local Businesses

Importers, distributors, and food processors in Latin America entering the date trade must navigate varied import regulations, ensure proper cold-chain logistics for quality control, and understand specific market and consumer trends, including the demand for premium varieties and innovative date-based products.

Regulatory and customs considerations

- Navigate diverse import requirements: Regulations, documentation, and tax structures differ across Latin American countries. For example, Argentina has adjusted import payment timelines, and Colombia requires an import registration form and presentation to customs. Importers must research and comply with each country’s specific rules.

- Obtain necessary health registrations: In countries like Peru and Colombia, processed food products need sanitary registrations. This often requires submitting official certificates from the country of origin, like a Certificate of Free Sale.

- Monitor labeling regulations: Food processors must comply with nutritional and warning labeling laws, which are subject to change. For example, Colombia introduced new nutritional labeling rules in 2022, with a recall deadline for non-compliant products. Mexico’s NOM-051 also outlines specific labeling requirements for pre-packed foods.

- Use HS codes correctly: Importers should correctly identify the Harmonized System (HS) code for dates to determine the applicable tariff rates, ensuring fair and predictable trade.

Logistics and quality control

- Address cold-chain limitations: Despite logistical market growth in Latin America, cold-storage capacity is limited, with low vacancy rates in major cities like São Paulo and Santiago. Importers and distributors must secure refrigerated transport and warehousing well in advance, especially during peak harvest seasons, to prevent spoilage.

- Ensure proper storage for fresh dates: Medjool and other fresh, moist varieties of dates require refrigeration. Proper storage in airtight containers at or below 40° F (4° C) is necessary to inhibit microbial growth and prevent spoilage.

- Handle dried dates carefully: Drier varieties like Deglet Noor have a longer shelf life and can be stored at room temperature, but should be kept in a cool, dark, and airtight environment away from heat sources. All date types must be protected from humidity and pests.

- Implement pest inspection protocols: Since organic dates are not treated with pesticides, they are susceptible to pests. Processors should inspect shipments for any signs of infestation, such as small brown specks, and have procedures for handling and discarding affected products.

Market and product strategy

- Know the competition: The dates market is competitive, based on quality, price, and service. Market research is crucial to understand competitors, consumer preferences, and the business environment.

- Target the premium market: Medjool dates command a significant market share due to their premium quality and taste. Processors can focus on this segment to capture higher margins, a strategy already proven successful in Mexico.

- Diversify into value-added products: Food processors can meet the rising demand for date-based innovations by producing and marketing date paste, syrup, and powder. The increasing focus on healthy snacking also provides opportunities for new product development.

- Align with consumer trends: Responding to the growing consumer interest in natural sweeteners, healthy snacking, and functional foods, food processors can highlight the natural benefits of dates in their marketing. This is a particularly strong trend in Brazil and Argentina, where consumption is rising. Source

4. Future Outlook: Trends That Will Shape the Market

Future trends in health, sustainability, and consumer habits are set to further boost the date industry in Latin America. The growing health consciousness and demand for clean-label, plant-based products, coupled with consumer preference for sustainable and ethically sourced ingredients, will drive innovation and increase market opportunities.

Health trends

- Rise of functional foods: Latin American consumers are increasingly seeking foods that offer specific health benefits beyond basic nutrition, a movement driven by heightened awareness of preventative healthcare. Dates, with their high fiber, mineral, and antioxidant content, are well-positioned as functional ingredients that aid digestive and cardiovascular health.

- Growing demand for natural sweeteners: As consumers prioritize healthier diets and reduce refined sugar intake, the demand for natural alternatives is rising. Date paste and syrup offer a nutritious, minimally processed option for both home cooks and large-scale food manufacturers, driving growth in bakery, confectionery, and beverage sectors.

- Personalized nutrition: The trend of personalized nutrition, fueled by AI and consumer technology, is creating opportunities for food products tailored to individual health goals. The date industry can capitalize on this by promoting dates as a customizable ingredient that fits various dietary needs, from providing energy for athletes to aiding digestion.

- Clean-label and wholesome ingredients: Latin American consumers are becoming more vigilant about product labels, actively seeking products with fewer, more natural ingredients. This provides a competitive advantage for dates and date-based products that can be marketed with simple, recognizable ingredients.

Sustainability trends

- Focus on local and sustainable sourcing: Consumers in Latin America increasingly prioritize locally sourced and sustainably produced ingredients. This creates a significant opportunity for regional date growers to compete with international imports by emphasizing their local roots and ethical farming practices.

- Regenerative agriculture: As seen with coffee farming in Brazil, there is a growing movement toward regenerative agriculture to combat climate change and improve soil health. Date palm growers can adopt these methods, such as reduced chemical use and efficient irrigation, to appeal to sustainability-conscious buyers.

- Upcycling and waste reduction: The food tech sector in Latin America is innovating to reduce food waste. Date processors can participate by upcycling date byproducts into new ingredients, thereby reducing waste and creating new revenue streams.

- Transparency and traceability: Using technologies like blockchain, food companies can provide consumers with transparent information about their products’ origin, processing, and environmental impact. Dates from Latin America can leverage this to build consumer trust and loyalty.

Consumer habits

- Expansion of vegan and plant-based diets: The vegan and plant-based food market is experiencing rapid growth across Latin America, driven by health, ethical, and environmental concerns. Dates and date-based products are a natural fit for this market, serving as a versatile ingredient in numerous plant-based food and beverage applications.

- Demand for “good mood” foods: Trends like “Restrained Hedonism” and “Mindful Choices” show that Latin American consumers are seeking healthier versions of indulgent treats. Dates, with their natural sweetness, can be used in “good mood” applications like low-sugar snacks, desserts, and functional beverages, providing comfort without guilt.

- On-the-go snacking: The fast-paced urban lifestyle in Latin America is fueling demand for convenient and portable food options. Dates are naturally well-suited for this market, both in their raw form and as ingredients in products like energy bars and balls.

- E-commerce and digital channels: The rise of online retail and social shopping platforms, particularly for younger consumers, offers a new avenue for marketing and sales. Date companies can use these digital channels to reach new customers, especially with innovative and specialized products. Source

Leave a Reply